Active selection of European equities, ranging from 20 to 30 investment lines to boost the momentum of your investment.

29 Haussmann Avenir Sélection

Offer

29 Haussmann Avenir Sélection offers the best of both worlds, while benefiting from active selection of European equities.

Active, opportunistic selection of European stocks, ranging from 20 to 30 investment lines.

- A conviction strategy based on an in-depth fundamental analysis of selected companies

- Active, opportunistic stock picking combining a quantitative and qualitative approach

- A practical approach, steering well clear of passing fads, trends or over-the-top market consensuses

- A team boasting an average of 25 years’ experience in the asset management industry.

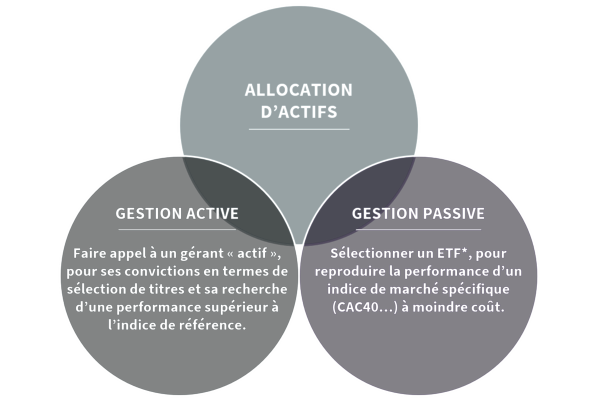

Our portfolio managers combine the best of active and passive strategies, while benefiting from an active selection of European equities. This gives them opportunistic access to European stocks, ranging from 20 to 30 investment lines.

Why choose SG 29 Haussmann Avenir Sélection ?

Active portfolio management to capture today’s potentialities

Unlimited access to the Discretionary Portfolio Management website and to the various resources and reports associated with the offer

A team experienced in asset management.

Passive portfolio management to capture market trends

Fully transparent pricing.

Q/A

By combining active selection of European equities with Active and Passive portfolio management approaches, the 29 Haussmann Avenir Sélection discretionary portfolio management solution gives you the best of both worlds and access to European equity market opportunities.

- Active, opportunistic selection of European stocks, ranging from 20 to 30 investment lines.

- Active conviction strategy drawing on the expertise of portfolio managers aiming to outperform the benchmarks. Portfolio managers have access to more than 240 internal Societe Generale funds as well as external funds.

- Passive portfolio management strategy implemented using instruments designed to replicate index performances. 29 Haussmann Avenir Sélection’s investment universe contains more than 200 conventional and thematic ETFs offered by Lyxor ETF.

Three risk profiles to meet your risk/return expectations as closely as possible

The portfolio may be exposed to Equities, within the limits of the established ranges.

- Defensive profile [0-40%]

- Balanced profile [30-70%]

- Aggressive profile [60-100%]