Active portfolio management to capture today’s potentialities

29 Haussmann Avenir

Offer

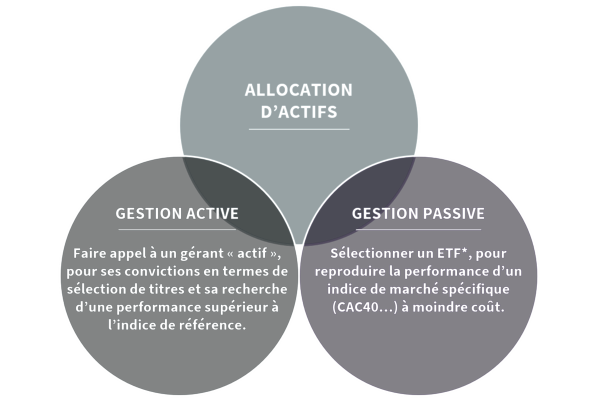

29 Haussmann Avenir gives you the best of both worlds, combining active and passive portfolio management.

Our portfolio managers combine the best of active and passive strategies to implement their thematic, sector or regional convictions.

They have access to more than 200 ETFs* and 200 funds, some of which are managed by the most renowned portfolio managers in the financial industry. Our portfolio managers also have a broad investment universe to choose from (equities, bonds and alternative investment products), resolutely targeting the international markets.

* An ETF (Exchange Traded Fund) or tracker is a financial instrument quoted on the stock exchange, used to reproduce the performance of a market index in real time.

Why choose SG 29 Haussmann Avenir ?

Three risk profiles, adjustable to your needs and risk appetite

Unlimited access to the Discretionary Portfolio Management website and to the various resources and reports associated with the offer

Passive portfolio management to capture market trends

Identification of the best portfolio management talents at SG 29 Haussmann

Fully transparent pricing.

Q/A

By combining active and passive approaches, the SG 29 Haussmann Avenir discretionary portfolio management mandate opens the door to the best of both worlds, allowing investors to find the right balance as market opportunities arise.

- Active conviction strategy drawing on the expertise of portfolio managers aiming to outperform the benchmarks. Portfolio managers have access to more than 240 internal Societe Generale funds as well as external funds.

- Passive portfolio management strategy implemented using instruments designed to replicate index performances. 29 Haussmann Avenir’s investment universe contains more than 200 conventional and thematic ETFs offered by Lyxor ETF.